General Ledger & EOM/EOQ/EOY Balances

General Ledger & EOM/EOQ/EOY Balances

For the small business that reports on a "Cash" basis. Fill in all receipts and payments for the month or the quarter into this journal and it will calculate your BAS Statement for you. C-70790

Members

For the small business that reports on an "Accrual" basis. Fill in all sales and purchases for the month or the quarter into this journal and it will calculate your BAS Statement for you. (C-45897)

Members

Simple, easy to complete, budget workbook for Last year, this year's budget and a page for each month. C-54749

Members

Budget workbook: Last year, this year's budget and a page for each month. C-49706

Members

Budget workbook: last year, this year's budget and a page for each month. C-38501

Members

Chart of Accounts for a partnership (State) operating in agricultural Australia. (C-57508)

Members

Chart of Accounts for an agricultural company. (C-74954)

Members

Chart of Accounts for a sole trader operating in agricultural Australia. (C-35740)

Members

Detailed chart of accounts for a company trading in goods, private or public, with a simple way of numbering the accounts. (C-52157)

Members

Special chart of accounts for an NGO Charity Ltd registered as a company limited by guarantee. (C-48445)

Members

Chart of accounts for an NGO Council Ltd registered as a company limited by guarantee. (C-49187)

Members

A detailed chart of accounts for a small business or a small company providing services and using MYOB or similar. (C-48915)

Members

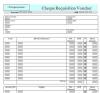

Control document for cheque payments. (AKA Payment voucher) C-86036

Members

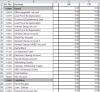

10-column EOY worksheet (MSExcel spreadsheet) based on properly developed chart of accounts for a company Ltd or Pty (public or private) trading in goods. C-13748

Members

A detailed 10-column EOY worksheet used in preparation for publication of Financial Report. C-97714

Members

Detailed 10-column EOY worksheet (MSExcel spreadsheet) based on properly developed chart of accounts for a non-profit NGO organization. C-32647

Members

10-column EOY worksheet (MSExcel spreadsheet) based on properly developed chart of accounts for a small business trading in services. C-96245

Members

A Trial Balance (in MSWord) based on the Chart of accounts for a company Ltd or Pty (public or private). C-91188

Members

A Trial Balance (in MSExcel) based on the Chart of accounts for a company Ltd or Pty (public or private). C-35187

Members

A Trial Balance (in MSExcel) based on the chart of accounts for an NGO Charity Ltd (above). C-75899

Members

A Trial Balance (in MSWord) based on the chart of accounts for an NGO Council Ltd (above). C-85772

Members

Trial Balance based on the chart of accounts for an NGO Council Ltd. C-92708

Members

A Trial Balance (in MSExcel) based on the chart of accounts for a small business involved in providing services. C-15333

Members

Simple 10-column worksheet (sole trader) balances as per the ledger at the end of year (EOY). C-21174

Members

10-column worksheet (partnership) MSExcel spreadsheet. C-67304

Members

Initial trial balance with balances as per the ledger at the end of year (EOY) and showing simple adjustments to the final figures. C-35624

Members

Initial trial balances for each company with balances as per the ledger at the end of year (EOY). C-27130

Members

Chart of Accounts for a Pty Ltd Company using Xero, selling a product COGS. (C-09018)

Members

Chart of Accounts for a Doctors' surgery using Xero. (C-13032)

Members

Chart of Accounts for a farming partnership. (C-09020)

Members

Chart of Accounts for a farming partnership, like husband & wife, engaged in a piggery. (C-09021)

Members

Chart of Accounts for a farming partnership, like husband & wife, engaged in sheep & wool, using Xero. (C-09019)

Members