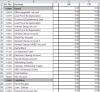

Books of account

Books of account

Newsletter Tax Matters on EOY tax matters & a Merry Christmas for year ended 31 December 2021. (TAX-11040). P-11040

Members

Newsletter Tax Matters & a Happy Holidays for Y/E 31 Dec 2022 (TAX-10147). P-10147

Members

Chart of Accounts for a Doctors' surgery using Xero. (C-13032)

Members

Newsletter on tax matters in Australia's Budget 2021. P-11018

Members

Chart of Accounts for a partnership (State) operating in agricultural Australia. (C-57508)

Members

Chart of Accounts for an agricultural company. (C-74954)

Members

Detailed chart of accounts for a company trading in goods, private or public, with a simple way of numbering the accounts. (C-52157)

Members

Chart of Accounts for a sole trader operating in agricultural Australia. (C-35740)

Members

Chart of accounts for an NGO Council Ltd registered as a company limited by guarantee. (C-49187)

Members

A detailed chart of accounts for a small business or a small company providing services and using MYOB or similar. (C-48915)

Members

Special chart of accounts for an NGO Charity Ltd registered as a company limited by guarantee. (C-48445)

Members

Chart of Accounts for a farming partnership. (C-09020)

Members

Newsletter Tax Matters on how to deal with EOY tax matters for year ended 30 June 2021. (TAX-11003). P-11003

Members

Newsletter Tax Matters on how to deal with EOY tax matters for year ended 30 June 2019. P-11002

Members

Chart of Accounts for a farming partnership, like husband & wife, engaged in a piggery. (C-09021)

Members

Chart of Accounts for a Pty Ltd Company using Xero, selling a product COGS. (C-09018)

Members

Chart of Accounts for a farming partnership, like husband & wife, engaged in sheep & wool, using Xero. (C-09019)

Members

Trial Balance based on the chart of accounts for an NGO Council Ltd. C-92708

Members

Invoice (Credit Adjustment) - also called a Credit Note. C-10141

Members

Invoice showing the basic price excluding GST, calculating GST on the Product Total. C-10538

Members

Planner for a business trip within Australia based on budget and actual to assist in planning next time around. C-10641

Members

A form for calculating car expenses based on the Logbook of Actuals (Fuel Excluded) method. C-12882

Members

10-column EOY worksheet (MSExcel spreadsheet) based on properly developed chart of accounts for a company Ltd or Pty (public or private) trading in goods. C-13748

Members

Invoice showing the price including GST, showing overall GST separately.

Free

A report prepared by the independent auditor of the company to accompany the annual financial statements for an unlisted public company. C-14397

Members

A form for calculating car expenses based on the Logbook of Actuals (Fuel Included) method. C-15205

Members

A Trial Balance (in MSExcel) based on the chart of accounts for a small business involved in providing services. C-15333

Members

A blank Purchase Order for buying a product with a product number and a unit price excluding GST. C-17754

Members

Sales Day Book for small business to get the BAS correct at the end of the month. C-19270

Members

An Invoice (Credit Adjustment) - also called a Credit Note.

Free

Simple 10-column worksheet (sole trader) balances as per the ledger at the end of year (EOY). C-21174

Members

Reconcilation of Cash Book with Bank Statement at the end of the month. C-21594

Members

An expanded worksheet Statement of Cash Flows based on the chart of accounts for a company limited by guarantee. C-22088

Members

A report prepared by the independent auditor to accompany the annual financial statements for a listed public company which is a disclosing entity. C-23242

Members

Fixed asset register to record the purchase and relevant details and disposal of important assets, say, over $10,000. C-23879

Members

Blank Purchase Order for buying a product with a product number and a unit price excluding GST. C-26315

Members

Initial trial balances for each company with balances as per the ledger at the end of year (EOY). C-27130

Members

Invoice (Credit Adjustment) - also called a Credit Note - showing the basic price excluding GST, calculating GST on the Product Total. C-30570

Members

Detailed 10-column EOY worksheet (MSExcel spreadsheet) based on properly developed chart of accounts for a non-profit NGO organization. C-32647

Members

A report prepared by the independent auditor to accompany the half-year (six months) financial statements. C-32942

Members

Invoice (Credit Adjustment) - also called a Credit Note. C-34997

Members