Books of account

Books of account

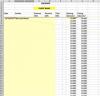

Depreciation schedule (MSExcel) prepared for inclusion in the Statement of Financial Position (Balance Sheet) at the EOY.

Members

Calculator. An expanded worksheet (different time periods) containing Depreciation schedules (in MSExcel) based on the reducing-balance method (also known as the declining-balance method). C-35777

Members

Calculator. An expanded worksheet (different time periods) containing Depreciation schedules (in MSExcel) based on the straight-line method.

Members

Depreciation schedules based on the units-of-production method. Used for factory machinery. C-74702

Members

Fixed asset register to record the purchase and relevant details and disposal of important assets, say, over $10,000. C-23879

Members

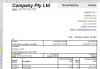

Invoice showing the basic price excluding GST, calculating GST on the Product Total. C-10538

Members

Invoice (Credit Adjustment) - also called a Credit Note - showing the basic price excluding GST, calculating GST on the Product Total. C-30570

Members

Invoice designed showing the basic price excluding GST, calculating GST on the Product Total. C-95276

Members

Invoice (Credit Adjustment) - also called a Credit Note. C-10141

Members

Invoice showing the price including GST, showing overall GST separately.

Free

Invoice (Credit Adjustment) - also called a Credit Note - showing the price including GST, & overall GST. C-55506

Members

Invoice showing the basic price excluding GST, calculating GST on the Invoice Total. C-70067

Members

Invoice (Credit Adjustment) - also called a Credit Note. C-40509

Members

Invoice showing the basic price excluding GST, calculating GST on the Invoice Total.

Free

Invoice (Credit Adjustment) - also called a Credit Note.

Free

Invoice designed for products and showing the price including GST, showing GST separately. C-66857

Members

Invoice (Credit Adjustment) - also called a Credit Note - showing the price including GST, showing GST separately.

Free

Invoice MSExcel entering the book price excluding GST and calculating GST on each line. C-39345

Members

Invoice (Credit Adjustment) - also called a Credit Note. C-34997

Members

Invoice MSExcel designed for products at rate per unit for entering final market price/unit including GST, calculating GST included on total invoice. C-91368

Members

An Invoice (Credit Adjustment) - also called a Credit Note.

Free

An invoice MSExcel designed for products for entering final market price including GST, calculating GST on each line.

Free

An invoice MSExcel designed for products for entering final market price including GST, calculating GST on total. C-79526

Members

Invoice for professional services rendered, with description of duties performed and hours and hourly rate. C-39152

Members

Invoice for professional services rendered, with description of duties performed but no hours or hourly rate. C-44456

Members

Invoice for professional services rendered, with description of duties performed with date performed but no hours. C-42924

Members

Invoice MSExcel for services and showing the hours and inclusive rates, with an "includes GST of" declaration. C-76231

Members

Invoice designed for a tradesperson showing GST per line. Excel spreadsheet version. C-77479

Members

A simple cash planner for small business, retail or services. C-48924

Members

Newsletter on tax matters in Australia's Budget 2021. P-11018

Members

Newsletter Tax Matters on how to deal with EOY tax matters for year ended 30 June 2019. P-11002

Members

Newsletter Tax Matters on how to deal with EOY tax matters for year ended 30 June 2021. (TAX-11003). P-11003

Members

Newsletter Tax Matters on EOY tax matters & a Merry Christmas for year ended 31 December 2021. (TAX-11040). P-11040

Members

Newsletter Tax Matters & a Happy Holidays for Y/E 31 Dec 2022 (TAX-10147). P-10147

Members

Register for tapes used to backup data outside of a standard backup routine. F-56384

Members

Petty cash voucher used by a small business with employees; includes signing upon receipt and authorisation by the bookkeeper. C-35659

Members